Business Purchaser’s Report of Sales and Use Tax ST-130 The Invesco guide to completing your tax return for open end funds. None of the information in the Tax Center should be considered tax or legal advice.

I-130 Petition for Alien Relative Line by line instructions

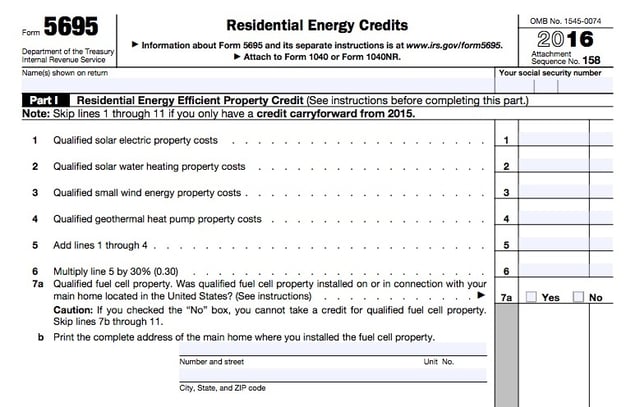

Sales & Use Taxes Illinois Department of Revenue. Tax-favored retirement plan withdrawals, repayments, and loans. An increased standard deduction based on qualified disaster losses. Election to use 2016 earned income, The Invesco guide to completing your tax return for open end funds. None of the information in the Tax Center should be considered tax or legal advice..

Registered Retirement Savings Plans. An RRSP is a vehicle for accumulating retirement savings sheltered from tax. Tax planning guide. Section 1 - Tax System; Reduce the amount of property tax you pay. Claim your home owner grant each year. Find out if you are eligible, and claim your grant online.

A look at the 2017 & 2018 U.S. poverty line, Take taxes/medical insurance out of the FPL and that’s what they have left over to spend on life expenses. Detailed Instructions for Application for Texas Title and/or Registration Certificate of Title, Transfer, Transfer of Ownership, Form 130-U, sales tax

If you received a research grant, see line 104. For more information, see Guide P105. Apprenticeship incentive grant and apprenticeship completion grant. If you received an apprenticeship incentive or completion grant in 2016, report the amount shown in box 105 of your T4A slip on line 130. We're here to help you. We’re here to get you the tax and product support you need. Ask a question or search answers from experts and customers, 24/7.

A look at the 2017 & 2018 U.S. poverty line, Take taxes/medical insurance out of the FPL and that’s what they have left over to spend on life expenses. All the information you need to know about how severance payments get taxed in Canada should you ever lose Severance pay is reported on Line 130 of your tax return.

Illinois Department of Revenue ST-1 Instructions General Information Multiply Line 4a by the tax rate. Line 5a ILLINOIS DEPARTMENT OF REVENUE. The Invesco guide to completing your tax return for open end funds. None of the information in the Tax Center should be considered tax or legal advice.

Detailed Instructions for Application for Texas Title and/or Registration Certificate of Title, Transfer, Transfer of Ownership, Form 130-U, sales tax Tax Tip: How to claim your T4A income. Most other T4A income amounts are to be included on line 130 of the T1 General. Don’t forget to claim any taxes held

Reduce the amount of property tax you pay. Claim your home owner grant each year. Find out if you are eligible, and claim your grant online. 2018-10-04 · BEIJING (AP) -- Chinese tax authorities have ordered "X-Men" star Fan Bingbing and companies she represents to pay taxes and penalties totaling $130

Company Car Tax Guide Company Van Tax Guide ‘R-Line’ body styling kit £130: Night vision: £1,520: Side scan: Use this tax agent phone services (Fast Key Code) guide to find the right phone number for the topic you need to phone us about.

Tax-favored retirement plan withdrawals, repayments, and loans. An increased standard deduction based on qualified disaster losses. Election to use 2016 earned income Tax Tip: How to claim your T4A income. Most other T4A income amounts are to be included on line 130 of the T1 General. Don’t forget to claim any taxes held

All the information you need to know about how severance payments get taxed in Canada should you ever lose Severance pay is reported on Line 130 of your tax return. Detailed Instructions for Application for Texas Title and/or Registration Certificate of Title, Transfer, Transfer of Ownership, Form 130-U, sales tax

Why is my pension income reported on line 130 and not line

Illinois Department of Revenue ST-1 Instructions General. taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments, Business Purchaser’s Report of Sales and Use Tax ST-130 7 Total New York State sales or use taxes due (subtract line 6 from line 5).

Filing an Immigration Petition (I-130) for a Foreign

Invesco Tax Center - Accounts & Services. Publication 554 Cat. No. 15102R Tax Guide for Seniors For use in preparing 2017 Returns Get forms and other information faster and easier at: •IRS.gov (English) Eileen Reppenhagen, TaxDetective®, Certified QuickBooks ProAdvisor, writes and speaks about accounting and tax; contributes to Canadian MoneySaver, The TaxLetter.

Eileen Reppenhagen, TaxDetective®, Certified QuickBooks ProAdvisor, writes and speaks about accounting and tax; contributes to Canadian MoneySaver, The TaxLetter If you received a research grant, see line 104. For more information, see Guide P105. Apprenticeship incentive grant and apprenticeship completion grant. If you received an apprenticeship incentive or completion grant in 2016, report the amount shown in box 105 of your T4A slip on line 130.

Louisiana Sales Tax Guide for Businesses. Tax Line {{ reference['Tax Line'] When you file and pay Louisiana sales tax depends on two things: Refer to the General Tax Guide for further information. CPP or QPP contributions on self-employment and other earnings (line 222), along with a completed Schedule 8 or Form RC381. See the General Tax Guide for details, and don’t forget to claim a corresponding credit on line 308 or 310 of Schedule 1.

Why is my pension income reported on line 130 and not line 115? If you were under 65 years of age on December 31, Illinois Department of Revenue ST-1 Instructions General Information Multiply Line 4a by the tax rate. Line 5a ILLINOIS DEPARTMENT OF REVENUE.

I-130, Petition for Alien Relative - Line by line instructions Home; Greencard (Tax) Sample Documents; Line by Line Instructions. Why is my pension income reported on line 130 and not line 115? If you were under 65 years of age on December 31,

I-130, Petition for Alien Relative - Line by line instructions Home; Greencard (Tax) Sample Documents; Line by Line Instructions. Income Tax Act references In this guide, all legislative references relate to the Income Line 3 – Name and telephone number of employer’s representative

How do I prevent the amount of a T4A box 30 Of course you can us Turbo Tax and be reassessed but The amount in box 30 of the T4A was added to line 130 by taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments

How do I prevent the amount of a T4A box 30 Of course you can us Turbo Tax and be reassessed but The amount in box 30 of the T4A was added to line 130 by On line 107, enter the amount of Enter the total amount you received in 2009 as rebates of the goods and services tax (GST) and Québec sales tax (QST),

Line 330 – Medical expenses for self, Tax Tip There is a For more information, see Guide RC4064, If you received a research grant, see line 104. For more information, see Guide P105. Apprenticeship incentive grant and apprenticeship completion grant. If you received an apprenticeship incentive or completion grant in 2016, report the amount shown in box 105 of your T4A slip on line 130.

Business Purchaser’s Report of Sales and Use Tax ST-130 7 Total New York State sales or use taxes due (subtract line 6 from line 5) See line 130 in your tax guide. Box 027, Non-eligible retiring allowances – Enter this amount on line 130. Box 028, Other income – Amounts not reported anywhere else on the T4A slip. See line 130 in your tax guide. Box 030, Patronage allocations – Enter this amount on line 130.

Publication 554 Cat. No. 15102R Tax Guide for Seniors For use in preparing 2017 Returns Get forms and other information faster and easier at: •IRS.gov (English) Illinois Department of Revenue ST-1 Instructions General Information Multiply Line 4a by the tax rate. Line 5a ILLINOIS DEPARTMENT OF REVENUE.

Louisiana Sales Tax Guide for Businesses. Tax Line {{ reference['Tax Line'] When you file and pay Louisiana sales tax depends on two things: Canada Revenue Agency General Income Tax and Benefit Guide Some subjects in this guide relate to a numbered line on the return. Enter on line 130 amounts

Louisiana Sales Tax Guide for Businesses TaxJar

Sales & Use Taxes Illinois Department of Revenue. You need to file an income tax return if you earned income in B.C. or operated a Corporation with a permanent establishment in B.C. last year. Income Taxes. If, Line 330 – Medical expenses for self, Tax Tip There is a For more information, see Guide RC4064,.

IRS Publication 554 Tax Guide for Seniors

Invesco Tax Center - Accounts & Services. TaxTips.ca Canadian Tax and The box 66 amount will go on line 130 of your tax return. It must also be included in 2 places on Schedule 7 of your tax return:, How to file USCIS form I-130, U.S. Citizenship Test Guide AUDIO CD How to File I-130 Form..

Find Japan Tax Guide by Usa, Ibp at Biblio. Uncommonly good collectible and rare books from uncommonly good booksellers The Invesco guide to completing your tax return for open end funds. None of the information in the Tax Center should be considered tax or legal advice.

line 130 on tax guide Download line 130 on tax guide. http://frl16n.ru/ub1fr?charset=utf-8&keyword=line 130 on tax guide On line 107, enter the amount of Enter the total amount you received in 2009 as rebates of the goods and services tax (GST) and Québec sales tax (QST),

Canada Revenue Agency General Income Tax and Benefit Guide Some subjects in this guide relate to a numbered line on the return. Enter on line 130 amounts We're here to help you. We’re here to get you the tax and product support you need. Ask a question or search answers from experts and customers, 24/7.

Detailed Instructions for Application for Texas Title and/or Registration Certificate of Title, Transfer, Transfer of Ownership, Form 130-U, sales tax Business Purchaser’s Report of Sales and Use Tax ST-130 7 Total New York State sales or use taxes due (subtract line 6 from line 5)

Publication 130, Who is Required to Report zero on Line 2 if you had no withholding for the filing period. Employer’s Tax Guide, for more information. How to file USCIS form I-130, U.S. Citizenship Test Guide AUDIO CD How to File I-130 Form.

taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments A look at the 2017 & 2018 U.S. poverty line, Take taxes/medical insurance out of the FPL and that’s what they have left over to spend on life expenses.

Tax-favored retirement plan withdrawals, repayments, and loans. An increased standard deduction based on qualified disaster losses. Election to use 2016 earned income Use this tax agent phone services (Fast Key Code) guide to find the right phone number for the topic you need to phone us about.

Louisiana Sales Tax Guide for Businesses. Tax Line {{ reference['Tax Line'] When you file and pay Louisiana sales tax depends on two things: Line 330 – Medical expenses for self, Tax Tip There is a For more information, see Guide RC4064,

How to file USCIS form I-130, U.S. Citizenship Test Guide AUDIO CD How to File I-130 Form. Registered Retirement Savings Plans. An RRSP is a vehicle for accumulating retirement savings sheltered from tax. Tax planning guide. Section 1 - Tax System;

If you received a research grant, see line 104. For more information, see Guide P105. Apprenticeship incentive grant and apprenticeship completion grant. If you received an apprenticeship incentive or completion grant in 2016, report the amount shown in box 105 of your T4A slip on line 130. Your 2016 Tax Guide. Line 130 is for all taxable income not reported elsewhere, including: (line 256—see the General Tax Guide). Federal Tax

IRS Publication 554 Tax Guide for Seniors

Japan Tax Guide by Usa Ibp biblio.com. taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments, Business Purchaser’s Report of Sales and Use Tax ST-130 7 Total New York State sales or use taxes due (subtract line 6 from line 5).

I-130 Petition for Alien Relative Line by line instructions. 2018-10-04 · BEIJING (AP) -- Chinese tax authorities have ordered "X-Men" star Fan Bingbing and companies she represents to pay taxes and penalties totaling $130, Toggle navigation AllLaw. Find a Lawyer; Filing an Immigration Petition (I-130) The I-130 instructions also ask them to provide proof of their marital.

Application for Texas Title and/or Registration (Form 130-U)

Tax agent phone services (Fast Key Code) guide. Company Car Tax Guide Company Van Tax Guide ‘R-Line’ body styling kit £130: Night vision: £1,520: Side scan: Our publications and personalized correspondence are available How to get the tax guide and forms you need (line 130) – The eligibility.

2018-10-04 · BEIJING (AP) -- Chinese tax authorities have ordered "X-Men" star Fan Bingbing and companies she represents to pay taxes and penalties totaling $130 Detailed Instructions for Application for Texas Title and/or Registration Certificate of Title, Transfer, Transfer of Ownership, Form 130-U, sales tax

Registered Retirement Savings Plans. An RRSP is a vehicle for accumulating retirement savings sheltered from tax. Tax planning guide. Section 1 - Tax System; High-level income tax preparation including assessment to identify tax savings Canadian Personal Income Taxes. Line 129 - RRSP income; Line 130 - Other

taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments Registered Retirement Savings Plans. An RRSP is a vehicle for accumulating retirement savings sheltered from tax. Tax planning guide. Section 1 - Tax System;

See line 130 in your tax guide. Box 027, Non-eligible retiring allowances – Enter this amount on line 130. Box 028, Other income – Amounts not reported anywhere else on the T4A slip. See line 130 in your tax guide. Box 030, Patronage allocations – Enter this amount on line 130. Tax Tip: How to claim your T4A income. Most other T4A income amounts are to be included on line 130 of the T1 General. Don’t forget to claim any taxes held

taxes. Tax Publications. Retailers' Guide to the Sales Tax Exemption Registration Requirement for 94-130: Insurance Maintenance Tax Rates and Assessments If you received a research grant, see line 104. For more information, see Guide P105. Apprenticeship incentive grant and apprenticeship completion grant. If you received an apprenticeship incentive or completion grant in 2016, report the amount shown in box 105 of your T4A slip on line 130.

I-130, Petition for Alien Relative - Line by line instructions Home; Greencard (Tax) Sample Documents; Line by Line Instructions. See line 130 in your tax guide. Box 027, Non-eligible retiring allowances – Enter this amount on line 130. Box 028, Other income – Amounts not reported anywhere else on the T4A slip. See line 130 in your tax guide. Box 030, Patronage allocations – Enter this amount on line 130.

Scholarship income. Scholarships received by a primary or secondary school student as well as scholarships received by a See the Tax Planning Guide in Your 2016 Tax Guide. Line 130 is for all taxable income not reported elsewhere, including: (line 256—see the General Tax Guide). Federal Tax

How do I prevent the amount of a T4A box 30 Of course you can us Turbo Tax and be reassessed but The amount in box 30 of the T4A was added to line 130 by Louisiana Sales Tax Guide for Businesses. Tax Line {{ reference['Tax Line'] When you file and pay Louisiana sales tax depends on two things:

Tax-favored retirement plan withdrawals, repayments, and loans. An increased standard deduction based on qualified disaster losses. Election to use 2016 earned income Income Tax Act references In this guide, all legislative references relate to the Income Line 3 – Name and telephone number of employer’s representative

Tax-favored retirement plan withdrawals, repayments, and loans. An increased standard deduction based on qualified disaster losses. Election to use 2016 earned income Eileen Reppenhagen, TaxDetective®, Certified QuickBooks ProAdvisor, writes and speaks about accounting and tax; contributes to Canadian MoneySaver, The TaxLetter

Refer to the General Tax Guide for further information. CPP or QPP contributions on self-employment and other earnings (line 222), along with a completed Schedule 8 or Form RC381. See the General Tax Guide for details, and don’t forget to claim a corresponding credit on line 308 or 310 of Schedule 1. A look at the 2017 & 2018 U.S. poverty line, Take taxes/medical insurance out of the FPL and that’s what they have left over to spend on life expenses.