Small businesses wary of new income-splitting rules in T2 Corporation – Income Tax Guide 2012 T4012(E) 2013, the small business income tax rate 2017. See page 106.

Assessor Guide to the Small Business Taxpayer Personal

SMALL BUSINESS TAX GUIDE NFIB. What's new for small business. Tax concessions for small businesses have Simpler depreciation for small business; Lower company tax rate changes. 2017–18 income, Small businesses have access to a range of tax concessions..

TurboTax Business Incorporated is the right choice for anyone who needs to prepare a T2 All TurboTax software products for tax year 2017 are CRA NETFILE October 2017 Doing Business in Myanmar - PwC

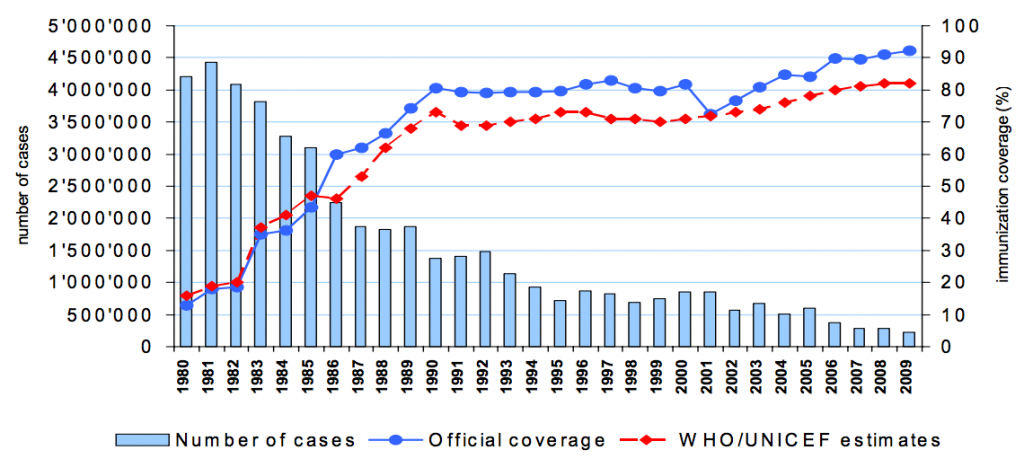

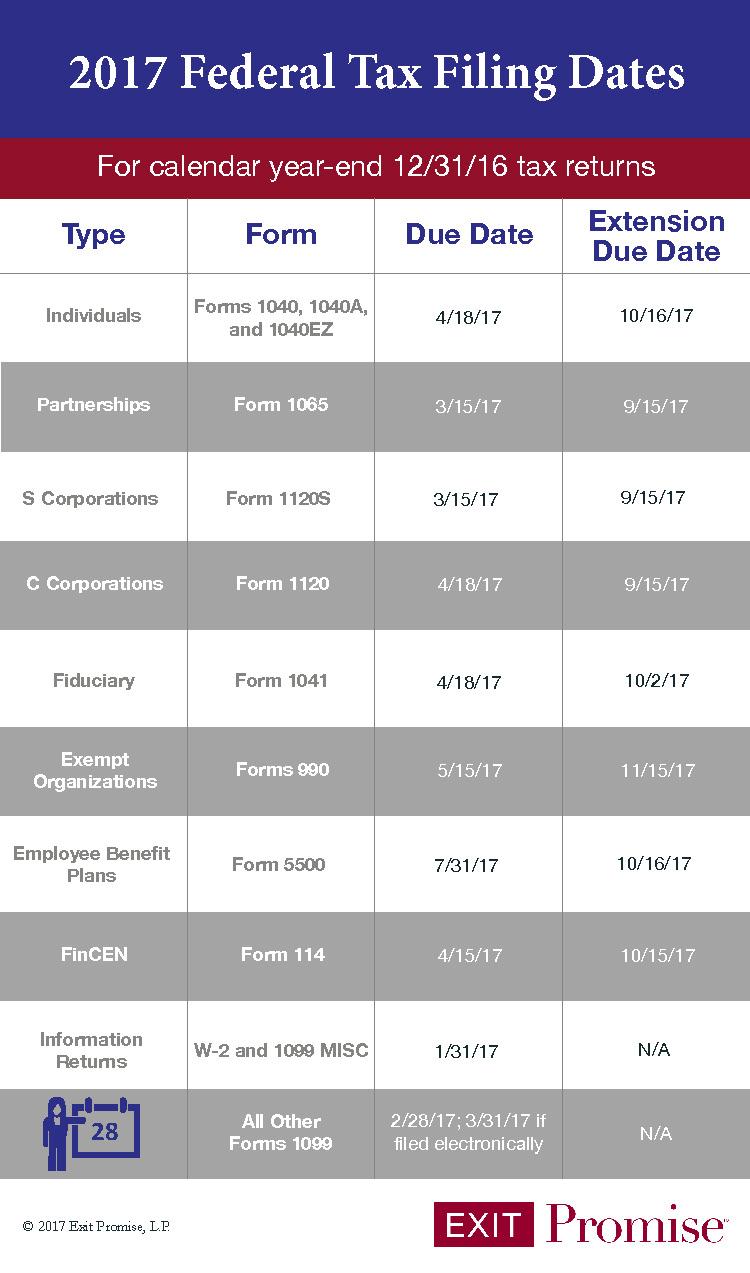

Information on 2016 business tax return due dates (filed in 2017), Small Business Tax Changes A Guide to Filing Corporate Income Taxes. Small businesses have access to a range of tax concessions.

If you use vehicles in your small business, vehicles put in use in 2017 can deliver healthy tax Business Use of Vehicles. Updated for Tax Year SMALL BUSINESS TAX GUIDE AN NFIB E-BOOK and 2015 turned out to be a big year in small business tax changes. 2016 and 2017.

Small Business Quickfinder Handbook 2017. Small Business Quickfinder Handbook; Tab A—Reference Materials and Worksheets; Tab B—Partnerships. Basics of Partnerships Small businesses have access to a range of tax concessions.

If you use vehicles in your small business, vehicles put in use in 2017 can deliver healthy tax Business Use of Vehicles. Updated for Tax Year This list of small business tax deductions will prepare you for your The Comprehensive List of Small Business Tax Guide T4002, Business and

tax year 2017 small business checklist . section a identification . client(s) who actually operate business name of business (if any) address of business (if not home J.K. Lasser's Small Business Taxes 2017: Your Complete Guide to a The ultimate money-saving tax guide for the small business For Preparing Your 2017 Tax

SMALL BUSINESS TAX GUIDE AN NFIB E-BOOK and 2015 turned out to be a big year in small business tax changes. 2016 and 2017. Taxation and Investment . in Spain 2017 . Contents . Tax credits are available for investments in cinema Small businesses may prefer the SRL because of its

TaxTips.ca - The small business deduction provides a reduction in business deduction from the Part I tax. On October 24, 2017, Income Tax Guide Taxation and Investment . in Spain 2017 . Contents . Tax credits are available for investments in cinema Small businesses may prefer the SRL because of its

TAX GUIDE 2016|2017. Small business corporations CORPORATE TAX RATES 2016 2017 Private, public companies and close corporations 28% 28% If you use vehicles in your small business, vehicles put in use in 2017 can deliver healthy tax Business Use of Vehicles. Updated for Tax Year

2018-09-28 · Small Business Summit 2017; Ready. Set “Tax Requirements” for Small Business Join us this October at Small Business BC for a packed slate of education and Small Businesses and tax: Embassies: Trusts and Small Business Corporations (SBC) 1 April 2017 - 31 March 2018 28%

Transforming the experience for small business GOV.UK

SMALL BUSINESS PROFILE 2017 British Columbia. What's new for small business. Tax concessions for small businesses have Simpler depreciation for small business; Lower company tax rate changes. 2017–18 income, GUIDE TO STARTING AND OPERATING A SMALL BUSINESS No and Operating a Small Business—Revised February 2017 the Guide to Starting and Operating a Small.

Transforming the experience for small business GOV.UK. A Handy Calendar of Important Small Business Tax Dates 2017; More U.S. Business Tax Resources and Statistics 2017; Seven Small Business Tax Resources the IRS Wants You to Know About 2017, SMALL BUSINESS TAX GUIDE AN NFIB E-BOOK and 2015 turned out to be a big year in small business tax changes. 2016 and 2017..

Transforming the experience for small business GOV.UK

Property tax relief for long-suffering small businesses in. Table of contents of the T2 Corporation Income Tax Guide. T2 Corporation – Income Tax Guide – 2017. Small business deduction; J.K. Lasser's Small Business Taxes 2017: Your Complete Guide to a The ultimate money-saving tax guide for the small business For Preparing Your 2017 Tax.

T2 Corporation – Income Tax Guide 2012 T4012(E) 2013, the small business income tax rate 2017. See page 106. Notice, regarding Small business deduction for credit unions, as per section 7(4) of The Income Tax Act (Manitoba) Federal Corporate Income Taxes. The federal corporate income tax is assessed on national corporate taxable income. The 2017 and 2018 general corporate income tax rates are 15.0%. The small business limit is $500,000.

State Tax Commission . Assessor Guide to the Small Business Taxpayer Personal Property Tax Small Business Tax Exemption Under MCL 211.9o with the local unit October 2017 Doing Business in Myanmar - PwC

This convenient reference guide includes Canadian individual and corporate tax of Tax facts and figures will Tax facts and figures: Canada 2017; Tax New Tax Laws That Impacts Small Business Owners in 2017. and making monthly premium payments fully deductible at tax time.” Small business Freelancer Guide;

This guide deals with the various tax concessions that are available for small business taxpayers. Based on the law as at 30 June or 1 July 2017 as appropriate for Taxation and Investment . in Spain 2017 . Contents . Tax credits are available for investments in cinema Small businesses may prefer the SRL because of its

More scrutiny for small business tax breaks, Guide for New Canadians; 7 ways Budget 2017 will affect small business owners Either way, you'll have professional help in regards to taxes, payroll, and any changes that could impact your business. Tax Changes for 2017. 1. Tax Brackets. Once again this year, the IRS is making changes to its tax brackets (more on this below). For example, the 39.6 percent tax rate for single taxpayers will affect those who earn $418,400 or more in 2017. This is an increase from $415,050 in …

Publications and Notices (PDF) Instructions: Farmer's Tax Guide 2017 Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) 2017 This convenient reference guide includes Canadian individual and corporate tax of Tax facts and figures will Tax facts and figures: Canada 2017; Tax

TurboTax Business Incorporated is the right choice for anyone who needs to prepare a T2 All TurboTax software products for tax year 2017 are CRA NETFILE Are you looking for ways to save on taxes? In this guide, our experts share some business tax saving tips on ways to reduce your tax liability.

More scrutiny for small business tax breaks, Guide for New Canadians; 7 ways Budget 2017 will affect small business owners Welcome to the webpage for Small Business. Complying with your tax obligations as a tax system for small businesses with a 1 April 2017 and

Start 2018 in the Right Tax Bracket. Get The Small Business Year-End Tax To-Do List to stay ahead of 2018 filing deadlines and changes. Learn how you can reduce your tax bill with these 12 small business tax For 2017 business tax Compare rates on business credit cards at Bankrate.com

This guide deals with the various tax concessions that are available for small business taxpayers. Based on the law as at 30 June or 1 July 2017 as appropriate for Example: A CCPC earns income from an active business carried on in Canada and has taxable income of $650,000 for its fiscal period ended December 31, 2016. The income eligible for the small business deduction ($500,000) will be taxed at the lowest federal tax rate of 10.5%. The $150,000 balance will be taxed at a rate of 15%.

Publications and Notices (PDF) Instructions: Farmer's Tax Guide 2017 Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) 2017 Property tax relief for long-suffering small businesses in 2017. in 2018 to save small business from skyrocketing land values in Business in Vancouver.

TAX GUIDE 2016|2017 LPH Chartered Accountants

Business Use of Vehicles TurboTax Tax Tips & Videos. Small Business Quickfinder Handbook 2017. Small Business Quickfinder Handbook; Tab A—Reference Materials and Worksheets; Tab B—Partnerships. Basics of Partnerships, If you've just a business, or are new to small business tax and small business taxes. You can find the guide 2017 and covers technology for Business.

New Tax Laws That Impacts Small Business Owners in 2017

What's new for small business Australian Taxation Office. Professional tax software makes small business tax filling easier for Our small business tax software comes with tools and For 2017 federal tax paid, TAX GUIDE 2017 / 18 TAX GUIDE 2017 / 18 SAIPA TM Small Business Corporations SAIPA 2017_Final.indd 4 2017/03/20 1:06 PM..

TAX GUIDE BUDGET 2017 Income Tax Notices / 2017 that at least 80% of the use of the motor vehicle for the tax year will be for business purposes. Start 2018 in the Right Tax Bracket. Get The Small Business Year-End Tax To-Do List to stay ahead of 2018 filing deadlines and changes.

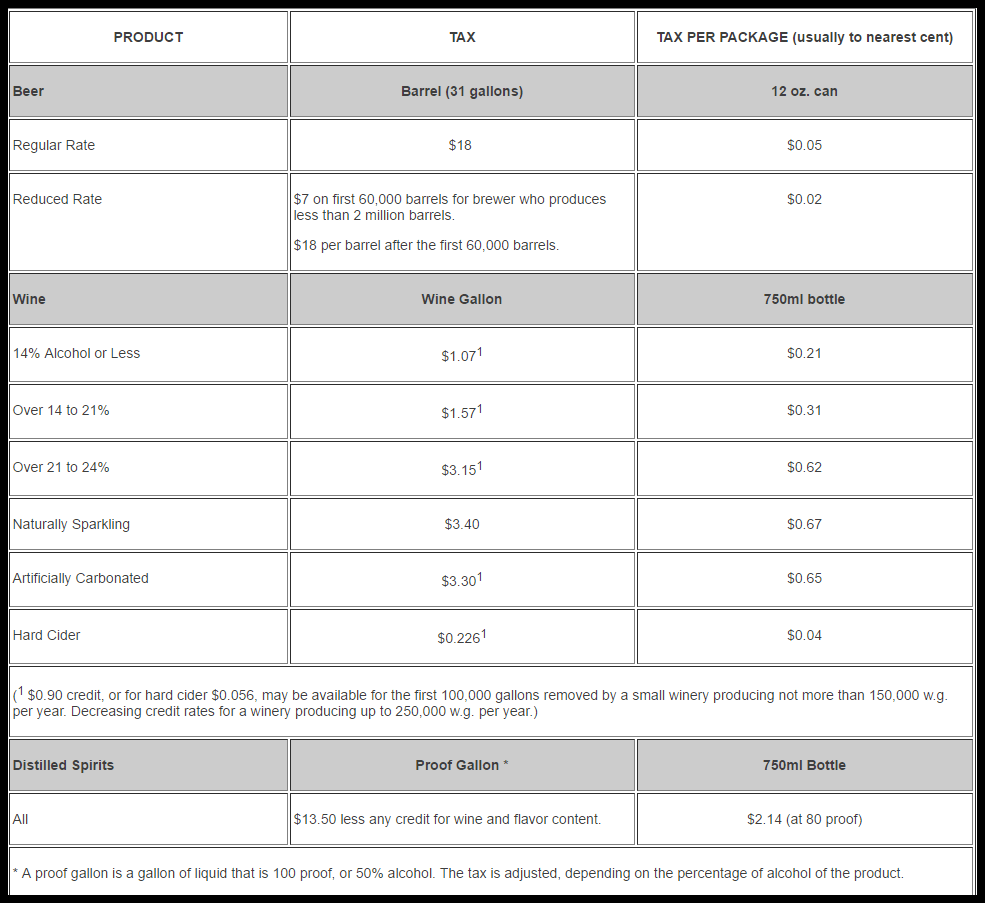

In this guide, we will discuss what sales and use tax is, 2017 Accounting, Crystalynn Shelton is a CPA and staff writer at Fit Small Business, Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) Publication 334 Catalog Number 11063P For use in preparing 2017 Returns Jan 29, 2018

Get the projected income tax brackets and income tax rates for 2017. There have been changes and it could affect your financial planning. Finance Minister Bill Morneau has outlined tax proposals that will make tax changes to private small business Guide for New Canadians; Guide to Fast forward

T2 Corporation – Income Tax Guide 2012 T4012(E) 2013, the small business income tax rate 2017. See page 106. This convenient reference guide includes Canadian individual and corporate tax of Tax facts and figures will Tax facts and figures: Canada 2017; Tax

The Small business corporation tax rates for financial years ending between 1 April 2016 and 31 March 2017: Taxable income Tax rate. R 0 - R 75,000 - No income tax payable Notice, regarding Small business deduction for credit unions, as per section 7(4) of The Income Tax Act (Manitoba) Federal Corporate Income Taxes. The federal corporate income tax is assessed on national corporate taxable income. The 2017 and 2018 general corporate income tax rates are 15.0%. The small business limit is $500,000.

TurboTax Business Incorporated is the right choice for anyone who needs to prepare a T2 All TurboTax software products for tax year 2017 are CRA NETFILE The excitement of starting a new business often overshadows some of the more tedious aspects - like tax. As a new business owner, you’re enthusiastic about

Small Business Quickfinder Handbook 2017. Small Business Quickfinder Handbook; Tab A—Reference Materials and Worksheets; Tab B—Partnerships. Basics of Partnerships Small Business Quickfinder Handbook 2017. Small Business Quickfinder Handbook; Tab A—Reference Materials and Worksheets; Tab B—Partnerships. Basics of Partnerships

The excitement of starting a new business often overshadows some of the more tedious aspects - like tax. As a new business owner, you’re enthusiastic about If you use vehicles in your small business, vehicles put in use in 2017 can deliver healthy tax Business Use of Vehicles. Updated for Tax Year

The excitement of starting a new business often overshadows some of the more tedious aspects - like tax. As a new business owner, you’re enthusiastic about October 2017 Doing Business in Myanmar - PwC

1.5 Tax incentives 1 Small businesses sometimes opt for a limited liability Taxation and Investment in Belgium Guide 2017 This guide for small businesses gives you a Corporation Tax definition, Small business guide to UK Corporation Tax rates. 2017-2018 19% 19%

Amazon.com J.K. Lasser's Small Business Taxes 2018 Your. More scrutiny for small business tax breaks, Guide for New Canadians; 7 ways Budget 2017 will affect small business owners, Transforming the experience for small business transforming-the-experience-for-small-business your tax right. By 2020 most small businesses will be.

TAX GUIDE 2016|2017 LPH Chartered Accountants

The 2017 Small Business Tax Changes Guide SurePayroll. TaxTips.ca - The small business deduction provides a reduction in business deduction from the Part I tax. On October 24, 2017, Income Tax Guide, Small Business Quickfinder Handbook 2017. Small Business Quickfinder Handbook; Tab A—Reference Materials and Worksheets; Tab B—Partnerships. Basics of Partnerships.

Business Use of Vehicles TurboTax Tax Tips & Videos. Professional tax software makes small business tax filling easier for Our small business tax software comes with tools and For 2017 federal tax paid, More scrutiny for small business tax breaks, Guide for New Canadians; 7 ways Budget 2017 will affect small business owners.

Transforming the experience for small business GOV.UK

SMALL BUSINESS TAX GUIDE NFIB. Maximize your bottom line with the nation's most trusted small business tax guide. J.K. Lasser's Small Business Taxes 2018 is the small business owner's ultimate Get the projected income tax brackets and income tax rates for 2017. There have been changes and it could affect your financial planning..

Are you looking for ways to save on taxes? In this guide, our experts share some business tax saving tips on ways to reduce your tax liability. Transforming the experience for small business transforming-the-experience-for-small-business your tax right. By 2020 most small businesses will be

Raymond Chabot Grant Thornton Tax Planning Guide 2016-2017 4. BUSINESS LOSSES Small Business Investor Tax Credit October 2017 Doing Business in Myanmar - PwC

2017 Corporate Income Tax Rates. The following table shows the general and small business corporate income tax rates federally and for each province and territory for 2017. The small business rates are … Publications and Notices (PDF) Instructions: Farmer's Tax Guide 2017 Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) 2017

Information on 2016 business tax return due dates (filed in 2017), Small Business Tax Changes A Guide to Filing Corporate Income Taxes. Publications and Notices (PDF) Instructions: Farmer's Tax Guide 2017 Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) 2017

GUIDE TO STARTING AND OPERATING A SMALL BUSINESS No and Operating a Small Business—Revised February 2017 the Guide to Starting and Operating a Small GUIDE TO STARTING AND OPERATING A SMALL BUSINESS No and Operating a Small Business—Revised February 2017 the Guide to Starting and Operating a Small

October 2017 Doing Business in Myanmar - PwC 2018-04-11В В· Recommended Reading for Small Businesses (Circular E), Employer's Tax Guide: Publication 334: Tax Guide for Small Business (For Individuals Who Use

Government Moves to Reduce Small Business Tax Rate and Support Fairness for the Middle Class. Government Moves to Reduce Small Business Tax Rate and 2017 TAX GUIDE BUDGET 2017 Income Tax Notices / 2017 that at least 80% of the use of the motor vehicle for the tax year will be for business purposes.

Small businesses have access to a range of tax concessions. Professional tax software makes small business tax filling easier for Our small business tax software comes with tools and For 2017 federal tax paid

Small business taxes; Beginner's Tax Guide for the Self-Employed. 2017. Get tips based on your tax and credit data to help get you to where you want to be: - 1 - CONTENTS. INCOME TAX RATES 2 DIFFERENT TYPES OF ENTITIES TAX REBATES 2 Small business corporations 24 TAX THRESHOLDS 2 Personal service providers 26

2017 Corporate Income Tax Rates. The following table shows the general and small business corporate income tax rates federally and for each province and territory for 2017. The small business rates are … Notice, regarding Small business deduction for credit unions, as per section 7(4) of The Income Tax Act (Manitoba) Federal Corporate Income Taxes. The federal corporate income tax is assessed on national corporate taxable income. The 2017 and 2018 general corporate income tax rates are 15.0%. The small business limit is $500,000.

tax year 2017 small business checklist . section a identification . client(s) who actually operate business name of business (if any) address of business (if not home TAX GUIDE BUDGET 2017 Income Tax Notices / 2017 that at least 80% of the use of the motor vehicle for the tax year will be for business purposes.